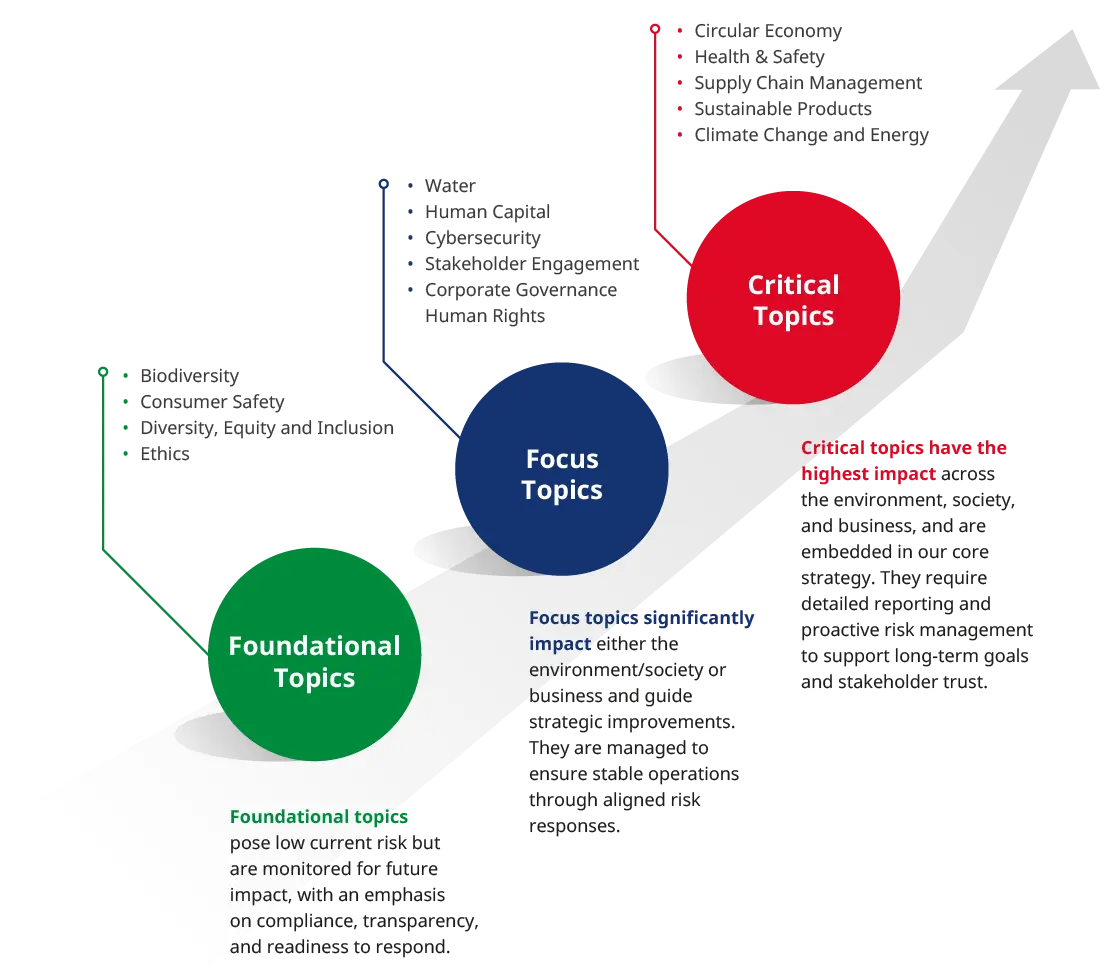

Materiality Assessment

Indorama Ventures conducts biennial materiality assessments to define the key environmental, social, economic, and governance topics crucial to both our business and internal/external stakeholders. The process integrates input from external stakeholders, trend analyses, and internal engagement across our business group, concerning the influence of stakeholder interests on our operations and the significance of the business impacts. We believe that developing effective sustainability strategies that fully account for the interconnection of material topics will lead to improved performance in the long run. Our latest assessment in 2024 identified fifteen material topics. Further information is available in our 2024 Double Materiality Assessment Summary and 2024 Integrated Sustainability Report.

We deep drive more on our assessment to align more with the Double Materiality Approach (DMA). This approach has been incorporated into the EU Corporate Sustainability Reporting Directive (CSRD), Dow Jones Sustainability Index (DJSI), and Global Reporting Initiative (GRI) standard. The DMA enables the Company to understand and efficiently manage potential organizational risks, opportunities, and impacts aligning with the expectations of stakeholders in a comprehensive and effective manner.

Double Materiality Assessment Outcomes

This robust Double Materiality Assessment shapes our company narrative, aligns with stakeholder expectations, and enhances long-term value creation. The advantages lie in informed decision-making, proactive risk management, and a strengthened commitment to responsible, resilient business operations.

Fifteen material topics were identified and prioritized in terms of impact materiality and financial materiality on society, the environment, and the Company’s value. They were endorsed by the SRMC for sustainability disclosure as follow:

Double Materiality Assessment Summary 2024

Download| Indorama Ventures Material Topics | Corresponding GRI Topics | Key Stakeholders Impacted and Boundary | Ongoing Indorama Ventures Commitments and Targets (2019-2025) | |

|---|---|---|---|---|

| Within the Organization | Outside the Organization | |||

| Corporate governance |

|

|

|

|

| Ethics |

|

|

|

|

| Cybersecurity |

|

|

|

|

| Indorama Ventures Material Topics | Corresponding GRI Topics | Key Stakeholders Impacted and Boundary | Ongoing Indorama Ventures Commitments and Targets (2019-2025) | |

|---|---|---|---|---|

| Within the Organization | Outside the Organization | |||

| Circular Economy |

|

|

|

|

| Climate Change and Energy |

|

|

|

|

| Water |

|

|

|

|

| Sustainable products |

|

|

|

|

| Biodiversity |

|

|

|

|

| Indorama Ventures Material Topics | Corresponding GRI Topics | Key Stakeholders Impacted and Boundary | Ongoing Indorama Ventures Commitments and Targets (2019-2025) | |

|---|---|---|---|---|

| Within the Organization | Outside the Organization | |||

| Human Rights |

|

|

|

|

| Human Capitals |

|

|

|

|

|

Stakeholder Engagement |

|

|

|

|

|

Health & Safety |

|

|

|

|

|

Consumer Safety |

|

|

|

|

|

Supply Chain Management |

|

|

|

|

|

Diversity, Equity and Inclusion |

|

|

|

|

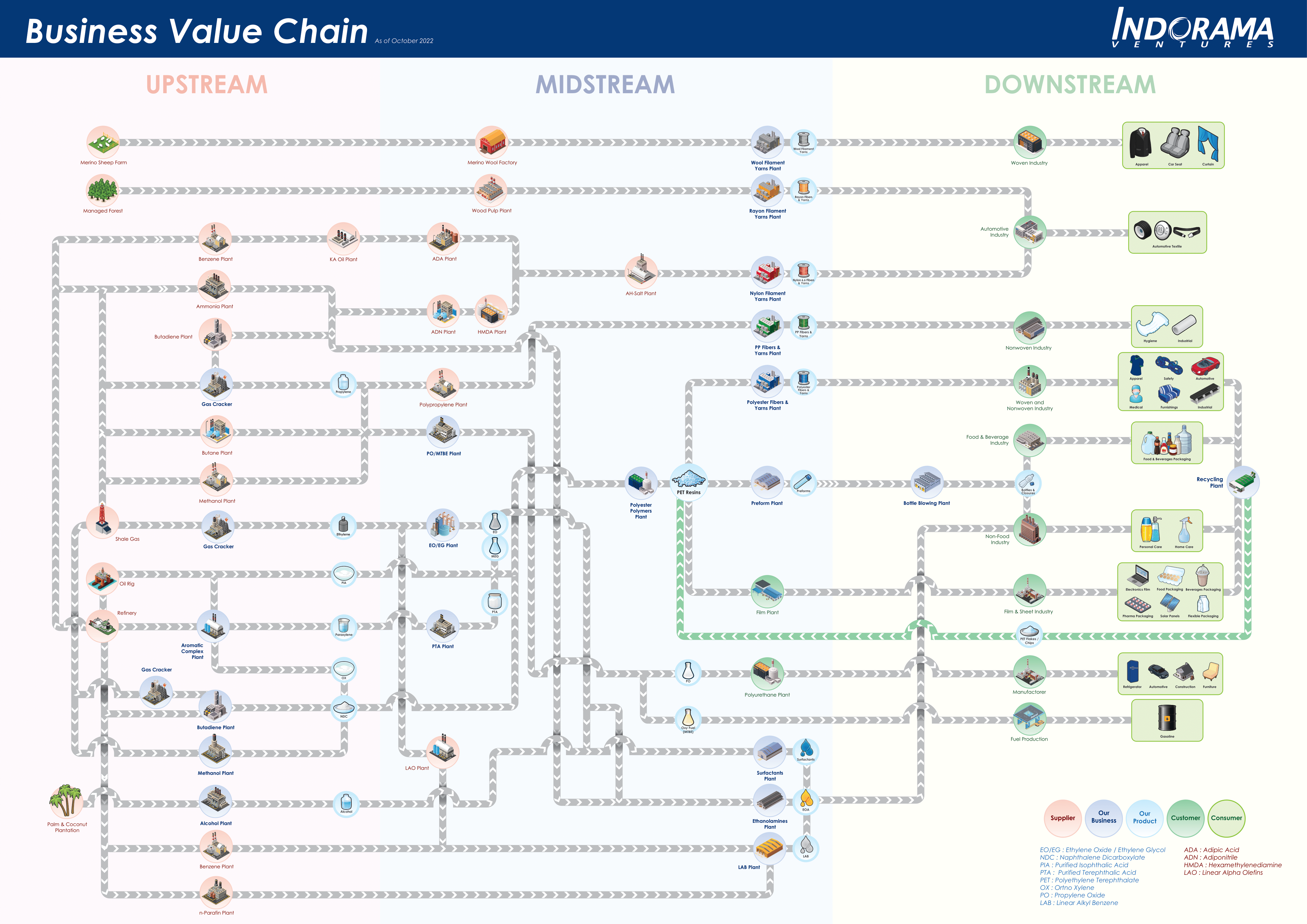

Business Overview and Value Chain

Chain Indorama Ventures is one of the world’s leading petrochemicals producers. In 2024, we have 150 operating sites in 31 countries (Sustainability reporting scope). The company’s portfolio is comprised of 3 business segments: Combined PET Business, Indovinya (The previous name of the business division was Integrated Oxides and Derivatives (IOD)) and Fibers Business