Risk Management

At Indorama Ventures we adopt an Enterprise Risk Management (ERM) framework which is aligned with the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and the International Organization for Standards’ ISO 31000 Risk Management.

Our effective risk management oversight structure is crucial in supporting risk management in our business Segments, and through the framework we embed sustainability and business resilience.

This forms the basis for decision-making about which risks are priorities, what the appropriate response should be, and how resources should be allocated to manage the risk or opportunity in a way that best supports Indorama Ventures’ strategy.

Risk Governance Structure

The ERM framework drives our risk management process which includes providing updates to the Indorama Management Council, Sustainability and Risk Management Committee and Board. Reporting cycles include Strategic Risks and our Business Risks and result in our annual risk management report.

At the core of our risk management process are risk committees and risk owners accountable for endorsing risk controls and action plans, providing effective risk understanding, authority and demarcation of accountabilities in risk management.

Risk Management

To ensure that Indorama Ventures remains resilient and responsive to challenges and opportunities, risk management is embedded as a mechanism for monitoring and managing uncertainty. It influences new opportunities for continuous and sustainable growth and to adapt strategies in a rapidly changing world.

We assess the potential impact and likelihood of risks associated with sustainable development and profitable growth. This includes internal and external risks, including global risks and associated factors that may affect the company’s operations due to increasing business and our international operations.

Where necessary, identified risks are allocated to a Risk Owner and analyzed, recorded, reported, and monitored through our risk management process. Appropriate control measures are monitored for their performance to ensure changes to risks are identified and their control activities are continuously updated and improved.

Across Indorama ventures we conduct a sensitivity analysis every six months to ensure sustainability, especially the environmental and social impacts to business operations. A water sensitivity analysis is conducted to identify water stress locations at all our operations globally. Any risks pertaining to human rights at our workplaces, and in supply chain are also part of our risk management.

At the corporate level, we conduct a sensitivity analysis every six months to ensure sustainability, especially the environmental and social impacts to business operations. The water sensitivity analysis is conducted to identify water stress locations at all our operations globally. The risks pertaining to the human rights risks at our work places, in supply chain are also part of the risk management.

Plant Crisis Management

We have introduced a Crisis Management playbook for use across Indorama Ventures which provides the common operating approach to crisis management and allows flexibility to respond to a range of incidents. These include incidents that are managed solely at a site using local resources, as well as incidents that draw on the full resources of Indorama Ventures.

We are now better prepared to respond to and recover from any disasters according to the Testing & Exercising (T&E) program for the Global Business Services (GBS) Business Continuity Plan (BCP), which effectively minimizes the impact on our operations while still serving our customers' expectations. Following this exercise, we determined areas for improvement that will help us be more prepared in the future. The 2023 T&E for GBS was completed in September 2023.

Business Continuity Management (BCM)

Business Continuity Management programs are implemented where appropriate to ensure continuity in the delivery of our products and services at predefined capacity during a disruption. Effective business continuity management ensures the company can provide a minimum acceptable operation in the event of a disaster, and helps to preserve our people, asset, reputation, and profitability.

As global supply chain disruptions continue to pose challenges to business operations, Indorama Ventures has proactively strengthened its supply chain resilience by completing critical supply chain BCPs for two key regions: the Thailand PET Supply Chain and Americas Ethylene Oxide Supply Chain. This safeguards against potential disruptions and ensures the uninterrupted flow of materials and products to our operations. By systematically assessing risks and vulnerabilities within these two supply chains, we can strategically implement mitigation measures to boost our resilience. These measures include implementing robust communication protocols with suppliers and partners, integrating operational procedures to ensure business continuity, and fine-tuning our scale-up approach.

Indorama Ventures has strengthened its supply chain resilience to reduce the risk of supply chain disruptions by concluding critical supply chain BCPs for the regions listed below:

AMER Region:

- Americas Ethylene Oxide Supply Chain

- North America and Mexico iPET Supply Chain

EMEA Region:

- Europe iPET product BCP

Asia Region:

- Thailand PET Supply Chain

Risk Culture

We support our employees and develop strategies and communications to produce positive cultural outcomes. This is continually refined to reflect ongoing changes in our business strategy.

We encourage a positive risk culture at our corporate office and in all our operations which helps to:

- Strengthen effective risk management.

- Promote sound risk-taking.

- Address immediate behavioral and other relevant issues ensuring a safer and healthier environment for our workforce.

- Ensure that emerging risks and excessive risk-taking, including M&A activities are assessed, escalated and addressed.

Communication and education are meaningful actions in developing risk awareness. We encourage open and upward communications, sharing knowledge and best practices, continuous process improvements, and a strong commitment to ethical and responsible business behavior.

We also foster an environment that both recognizes and rewards people for paying attention to risk, both positive and negative, to reward the right kind of behavior. Employee Suggestions, Incentives, and Near-miss Reporting are just some of our programs that regularly promote a positive risk culture.

Risk Assessment and Mitigation

We conduct a comprehensive bi-annual review of critical risk areas based on defined performance indicators. This process involves a detailed examination of the causes and consequences associated with risks and evaluating the effectiveness of existing risk control plans. In addition to the current controls in place, we proactively develop supplementary plans to further reduce risk to a level deemed as low as reasonably possible.

| Key Risk Areas and Control Plans | ||

|---|---|---|

| EHS | EHS incidents may result from non-compliance to process safety, occupational safety, and environmental management procedures |

|

| Cybersecurity | Inability to effectively manage cybersecurity risks may impact our business, reputation, and value proposition. |

|

| Regulatory and Corporate Compliance | Adverse regulatory changes could lead to higher costs of compliance and impact our value proposition. |

|

| Growth Strategy | Delayed achievement of business objectives due to ineffective execution of growth strategies, such as mechanical recycling |

|

| Value Chain | Profitability may be affected across the business value chain due to adverse market conditions and supply chain disruptions. |

|

Risk Factors

We develop management strategies for strategic and operational risks, as well as associated factors that may have a material adverse effect on the implementation of business strategy, financial performance, results of operations, cash flow, liquidity, and shareholder value. The strategies are devised to best meet the needs of the organization.

Business and Operational Risks

Geopolitical instability

The world continues to face geopolitical instability that is developing toward geoeconomic fragmentation affecting all economies, with emerging markets and low-income countries likely to suffer the most. These issues impact our business as governments, in response to political and social pressures, pursue policies that could have a material adverse effect on our earnings, cash flows, and financial condition. We work relentlessly to manage the impact of these changes, monitoring the geopolitical landscape in the countries where we have business and operations, and developing and maintaining relationships with government agencies, stakeholders, and partners. When necessary, we implement changes relevant to our interests to reduce the impact on Indorama Ventures.

Competition and market

Our ability to achieve strategic objectives depends on how we react to market conditions, price fluctuations, and raw material supply reliability, as well as how effectively we develop and deploy new technology and products to respond to environmental, social, and governance expectations. We continually assess the markets and underlying economic, political, social, and environmental drivers to evaluate changes in competitive forces. We leverage integration and diversification of our manufacturing facilities across geographies, product diversification, and other operational excellence measures to achieve competitiveness through commercial success. We lead in partnering with technology companies, regulators, customers, and brand owners to develop next-generation sustainable products.

Human capital

Our performance depends on the successful development and deployment of our people. The inability to attract, develop, and retain people with the necessary skills and capabilities could impact successful strategic delivery. We successfully recruit, develop, and retain people, investing in our value proposition and working in collaboration with universities and internship programs around the world. With diversity, equity, and inclusion at our core, we continue to drive various capability and development programs globally.

Technology

Cybercrime is increasing in frequency and sophistication, worsened by geopolitical instability. To manage exposure, we implement internationally recognized standards and advanced AI-based self-learning technology to detect threats. Our capabilities include text, QR code, optical character recognition, log collection, analysis, dark-web monitoring, and scanning vulnerabilities in both on-premises and cloud systems. We provide threat intelligence through AI for information security and IT management. We also promote cyber awareness, shape behaviors, and embed new practices to mitigate cybersecurity breaches and attacks.

Strategic Risks

Trade uncertainty

At Indorama Ventures we acknowledge that rising trade uncertainty, particularly around tariffs, has re-emerged in early 2025. Indorama Ventures’ local-for-local operating model, with manufacturing facilities positioned close to major customers across North America, EMEA, South America and Asia, provides a buffer against such external shocks. The majority of our products are consumed within the same country where they are produced, significantly limiting cross-border exposure. Indorama Ventures also closely monitors market developments and remains committed to working alongside our customers and suppliers to stay agile, reinforce supply chain resilience, and strengthen the competitiveness of our value chain.

Regulatory Risks

Exposure to changes in legal and/or regulatory requirements could potentially result in project delays or cancellations, operating restrictions, and additional compliance obligations. We are committed to protecting the environment, fully complying with applicable environmental laws and regulations wherever we have operations. We routinely monitor potential regulatory changes, continue to focus on efficiency improvements, and adhere to GHG reduction goals and targets as defined and disclosed in our Sustainability Reports. We participate in best-in-class benchmarking assessments, recognized for their independent reporting on sustainable business practices, which are critical to generating long-term shareholder value and aligning our decarbonization strategy.

Financial Risks

Indorama Ventures and its subsidiaries had a total outstanding debt of THB 244 billion at the end of 2024. The total outstanding debt includes bank overdrafts, short-term loans, long-term loans, debentures/bonds, and financial lease liabilities. The net debt-equity ratio at the end of 2024 was 1.76 times, compared to what is required under financial covenants of equal to or less than 2.00 times. The total shareholders’ equity at the end of 2024 was THB 139 billion (including perpetual debentures of THB 15 billion). In addition, syndicated bank loans at the regional level and subsidiaries with standalone financing are required to meet financial obligations and comply with financial covenants. In October 2024, the domestic credit rating of Indorama Ventures was reaffirmed at AA- with change in outlook to Negative by TRIS. Indorama Ventures aims to strengthen its business and financial profile to enhance its credit rating. At Capital Markets Day 2024, Indorama Ventures announced a financial target for net debt-EBITDA below 3 times by the end of 2026.

ESG-related Risks

Climate-change-driven energy transition

We experience exposure to the effects of energy transition and the associated fluctuations in energy supply and market conditions. We constantly monitor market conditions, deploying our energy cost hedging policy to mitigate fluctuations. We will continue to seek opportunities through energy transition to increase our use of renewable energy, further reduce our carbon footprint, and maintain contingency plans for temporary energy supply rationing.

Physical effects of climate change on operations

Exposure to the adverse effects of the changing climate, with increasing variations in seasons, temperature, sea levels, and fluctuations in water levels, is adversely affecting our operations. We are committed to sustainable water management, complying with applicable environmental laws, and international standards and regulations wherever we have operations. We routinely monitor potential regulatory changes, evaluate water risks and opportunities, identify water stress locations, and work with agencies and authorities to understand water supplies and avoid potential conflicts with the societies in which we operate.

Emerging Risks

1. Failure to Promptly Mitigate and Adapt to Climate Change

Climate change is a major and growing risk for all regions where we operate. The delay in the Chemical Sectoral Decarbonization Approach (until December 2024) could impact us in the mid- and long-term as regulations are confirmed, while geopolitical competition is also a key risk factor for the global energy transition. There are currently no proven, cost-effective technologies, making climate change mitigation and adaptation an ongoing challenge. This risk is in line with the WEF Global Risks Report 2024.

Impacts:

- Increased carbon taxes and fines for exceeding emission limits and non-compliance.

- Loss of economic opportunities and product premiums from the carbon footprint in existing and new products.

- Impact on market positioning and market share, and sustainability leadership due to insufficient commitment to Net Zero.

- Increased insurance premiums, reduced sustainable finance opportunities, and loan penalties.

- License to operate will be at risk due to noncompliance and could lead to license termination or suspension.

Mitigation Plans:

- Monitor laws and regulations in all regions and participate in industry associations to drive the climate change agenda in the sector.

- Assess climate-related risks and opportunities and water risk, including scenario analysis and natural disaster risk.

- Track decarbonization performance for effective management and identify further actions.

- Conduct business continuity planning (group, business, and site levels)

- Engage with stakeholders to decarbonize the supply chain.

- Develop mitigation and adaptation plans (process and product) aligned with decarbonization strategies and Net Zero requirements.

2. Biodiversity Loss and Ecosystem Collapse

With 140+ operational sites in 35 countries, Indorama Ventures faces significant threats from biodiversity loss and ecosystem collapse—among the most severe threats over the next decade. These critical issues, along with pollution, resource depletion, climate change, and socioeconomic pressures, could disrupt global supply chains, the economy, and society.

Impacts:

- Environmental degradation impacts include floods, sea-level rise, erosion, disease outbreaks, and water stress.

- Violent conflict, resource scarcity, supply chain disruptions, and higher raw material costs.

- Operational restrictions, delays to projects, new standards, regulations, and clean-up costs.

- Financial burdens stem from biodiversity-related taxes and licensing requirements. Financial ramifications could be significant. For example, if production ceased at sites with high biodiversity risk, this could result in over $ 45 million estimated annual EBITDA loss.

- Reputational damage caused by environmental and social impacts, possibly leading to social unrest, and threatening our social license to operate.

Mitigation Plans:

- Addressing biodiversity risks by implementing a Biodiversity Risk Assessment to identify and manage risks.

- Boosting operational eco-efficiency by adopting advanced technologies and promoting a circular value chain, reducing environmental impacts, and innovating sustainable products with lower carbon footprints.

- Managing biodiversity risk with short-, medium-, and long-term, integrating these into our strategy, aligned with our decarbonization and sustainability goals.

Further details are available in Table 7 in our TNFD Report 2023

3. Increasing Regulations Disrupt Supply Chains and Reduce Market Access

We are now facing a more uncertain environment influenced by geopolitical and regulatory factors. Regional conflicts and instability threaten supply chains and market access. We rely on the availability and affordability of raw materials, energy, and intermediate products, as well as access to end-use markets. Increasing regulatory pressures (e.g. EU ETS, EU Carbon Tax, and CBAM), stringent ESG regulations in different jurisdictions (e.g., EU CSRD, EU Taxonomy, EU Plastics Tax, German Supply Chain Act), as well as the growing ESG backlash further complicate operations. This risk aligns with the WEF Global Risks Report 2024.

Impacts:

- Increased costs and availability issues of raw materials, energy, and intermediate products.

- Reduced operational flexibility and potential plant interruptions/shutdowns.

- Disrupt supply chains and reduce demand for chemical products, resulting in loss of market share and economic opportunities.

- Trade tensions and conflicts lead to higher tariffs, barriers, and trade and investment uncertainties.

- Sanctions and embargoes limit the export or import of certain chemical products, raw materials, or technologies, and access to financial markets, as seen with the EU sanctions on Russia.

Mitigation Plans:

- Closely monitor related laws and regulations and analyze geopolitical risks, including interstate conflicts.

- Evaluate current and future supply chain risks and opportunities, use scenario analysis and operational restructuring to optimize and localize supply chains.

- Conduct business continuity planning (group, business, and site levels).

- Engage with stakeholders to develop supply chain resilience plans and participate in industry associations to address ESG and supply chain issues.

- Integrate regulatory requirements into process operations and product stewardship.

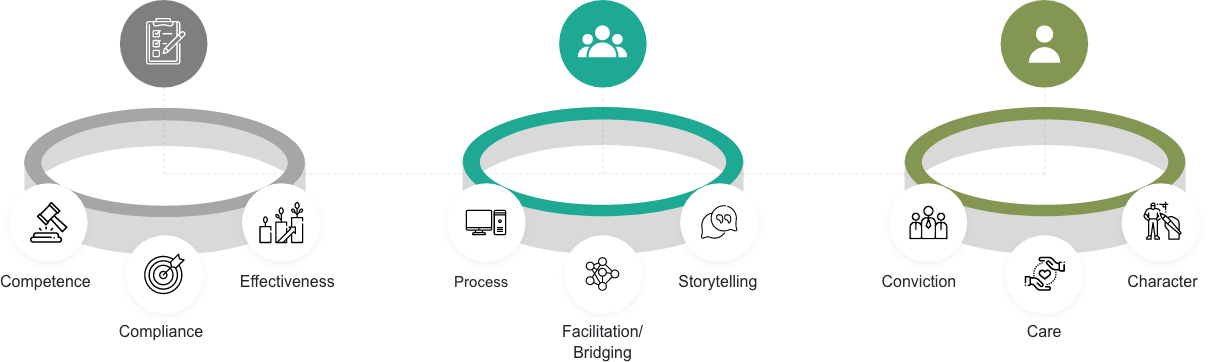

Risk Capability & Culture Leadership Program

We developed and implemented a carefully curated Risk Capability & Culture Leadership Program covering top 80 global leaders across the organization to enhance risk capability and elevate risk thinking to drive agility in addressing the ever changing business environment. This program combines both experiential learning and tools to strengthen risk leadership mindset in leaders to shape the masses and envision future state of risk.

Risk Capability

Upskilling on the overall landscape of Risk Management, Crisis and Business Continuity Management emphasizing tools and effectiveness imparting value through best practices and lessons learnt.

Credible Risk Champion

Shape leaders’ risk management aptitude, confidence, drive and conviction for risk through experiential knowledge transfer and facilitated activities.

Risk Conversation

Dedicated open discussion on risk management to surface timely key risk/ achieve risk target involving leaders and related parties through rigorous facilitated deliberation & challenge.

VALUE

Foundational Risk Management capability building for Leaders by providing tools/ methodologies to support decisionmaking & business objectives.

VALUE

Creates Risk platform to reflect & react where Risk becomes the Top of Mind, leaders as Risk model and champion to constituent.

VALUE

Elevating Leaders as credible risk advocates by strengthening confidence, drive and conviction on risk management to shape masses’ risk culture and practices.

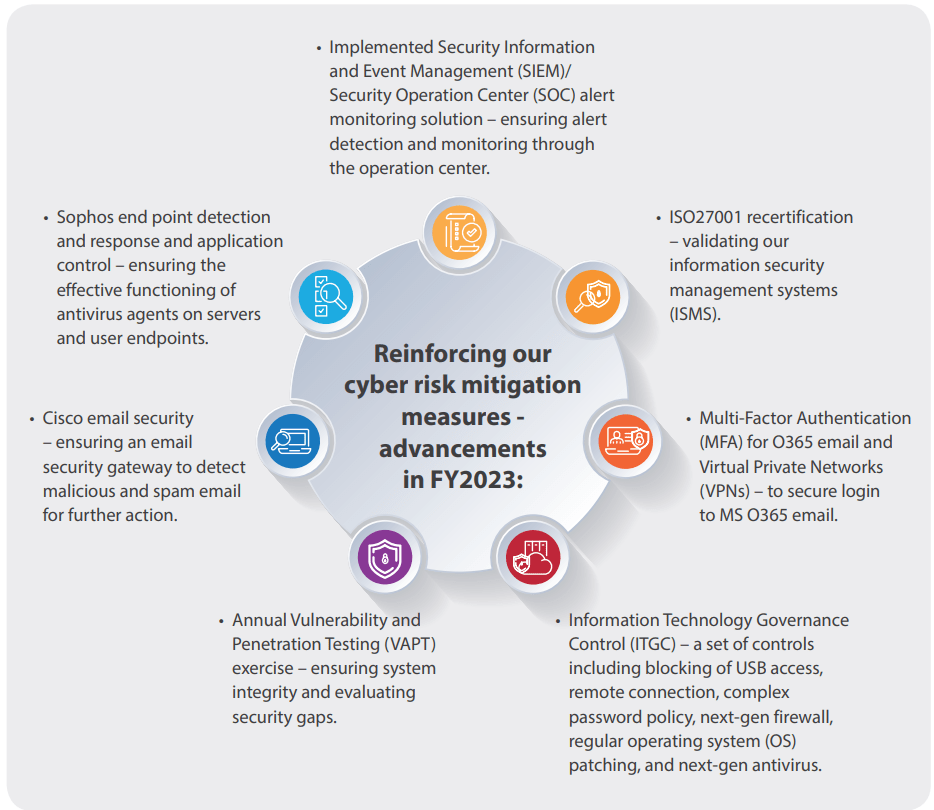

Cybersecurity

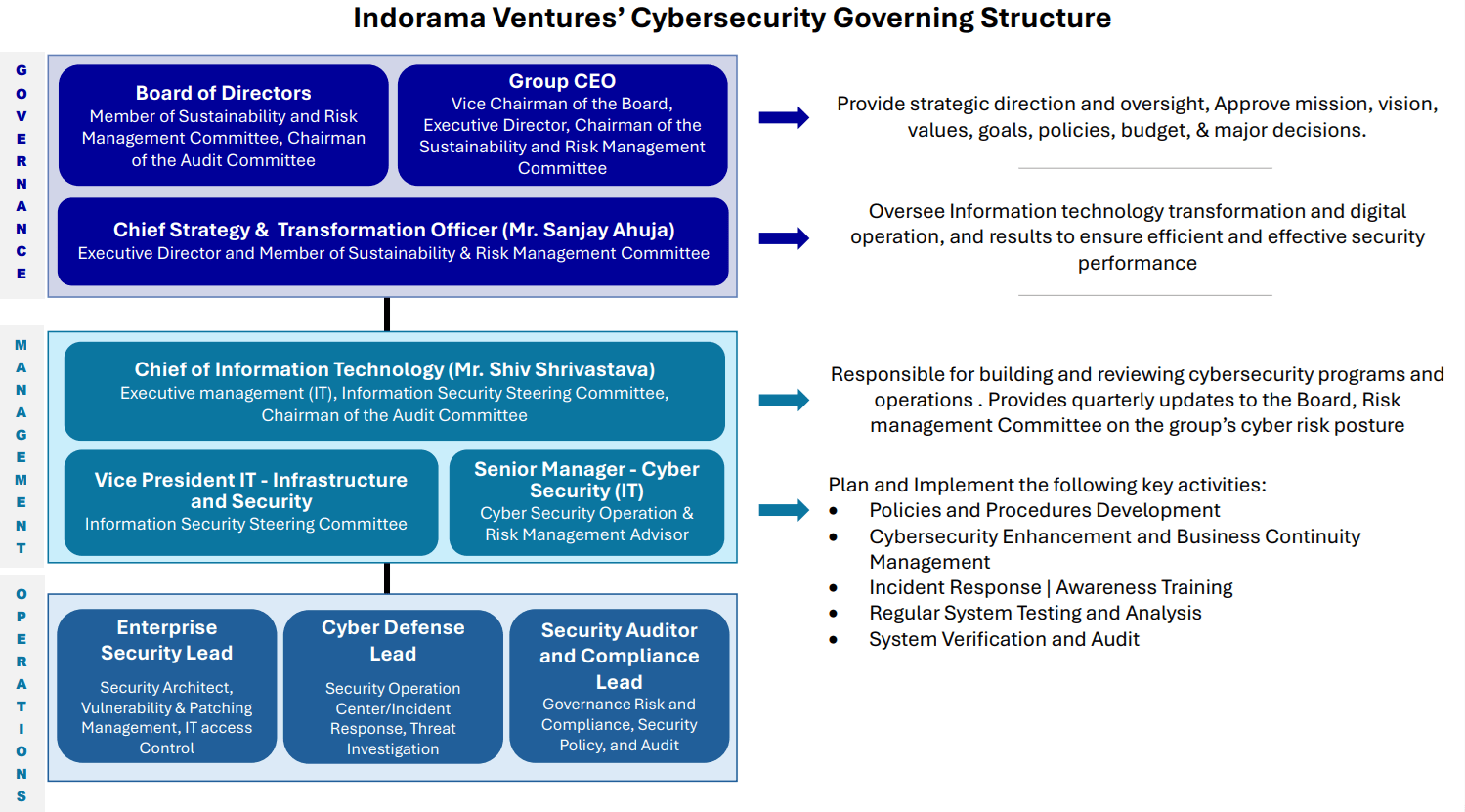

We have intensified our commitment to IT security and cybersecurity, reinforcing our systems and processes to effectively address these evolving threats. The rising prevalence of digital technologies and information technology (IT) has allowed Indorama Ventures to achieve operational and commercial excellence. However, the surge in digitalization and global connectivity has also heightened the risk of cyber threats and data breaches, impacting our business operations, continuity, and reputation.

The Sustainability Risk and Management Committee (SRMC) and Audit Committee maintain oversight of Indorama Ventures’ cybersecurity resilience, actively monitoring our cybersecurity framework and developing robust policies and procedures that align with our risk appetite. Cybersecurity governance is overseen by our Board member in providing the direction and suggestions on the development and implementation of our cybersecurity strategy in compliance with industry standards, addressing the risks associated with our IT security and cybersecurity to safeguard and ensure the resilience and security of our digital systems.

IT Security Policies

The Corporate IT Security Team has established a comprehensive set of IT security policies aligned with the ISO 27001 ISMS framework. These policies form the foundation of our organization’s IT and security procedures. We are dedicated to the ongoing enhancement of our security posture by regularly aligning global IT policies with the ISMS framework, thereby maintaining a robust and resilient security infrastructure now and into the future.

Indorama Ventures is committed to the continual advancement of its Information Security Management Systems (ISMS) to guarantee the integrity, confidentiality, and availability of information assets. To safeguard data against unauthorized access, modification, destruction, or disclosure, we implement rigorous technical, administrative, and physical controls. We systematically monitor, evaluate, and update our security policies, procedures, and controls to address emerging threats, technological advancements, and changes in business operations. Additionally, we proactively identify, analyze, and respond to potential security incidents in a timely and effective manner.

This commitment encompasses:

- Conducting periodic risk assessments and security audits to pinpoint areas for improvement.

- Performing regular management reviews to assess the effectiveness of security measures.

- Implementing corrective and preventive actions based on audit results, incidents, and user input.

- Enforcing stringent access controls and authentication measures to preserve data integrity.

- Utilizing encryption and secure transmission protocols to protect data both at rest and in transit.

- Carrying out routine integrity checks and audits to detect and prevent unauthorized data alterations.

- Ensuring the prompt execution of backups and disaster recovery procedures to maintain data availability and resilience.

- Continuously monitoring networks, systems, and applications for indications of unauthorized access or unusual activity.

- Gathering threat intelligence and conducting vulnerability assessments regularly to proactively mitigate potential risks.

Individual Responsibilities for Information Security

- Every member of the workforce is responsible for safeguarding the confidentiality, integrity, and availability of the information they access or handle.

- Employees are required to promptly report any suspected security incidents, vulnerabilities, or violations to the designated information security team.

Information Security in Third-Party Relationships

Indorama Ventures ensures that all third parties—including suppliers, contractors, and service providers—comply with defined information security requirements when accessing, processing, storing, or transmitting organizational information.

- Security requirements are clearly defined and documented within contracts, agreements, and service level agreements (SLAs).

- Due diligence and risk assessments are performed prior to engaging third parties to evaluate their security capabilities.

We continuously apply physical and network security measures, incident response planning, employee training, and system enhancements as part of our efforts, while complying with relevant laws such as the Personal Data Protection Act and updating our IT security policy.